Don't Settle For Less Than You're Entitled To

FIRE DAMAGE

Fire & smoke damage claims should always include the infrastructural source of the fire & the physical objects damaged by it.

WATER DAMAGE

Water damage can appear minimal on the surface but under the floor or behind walls might be brewing a larger problem. We look for the possibility of unseen damages.

STORM DAMAGE

Whether from lightning, hail or wind it’s no fun when a storm takes a piece of your property. Our objective is to restore your peace.

BUSINESS INCOME LOSS

Experiencing a sudden halt to your business can be incredibly stressful. We take these matters seriously & act vigorously to secure compensation for income losses while facilitating the restoration of your business.

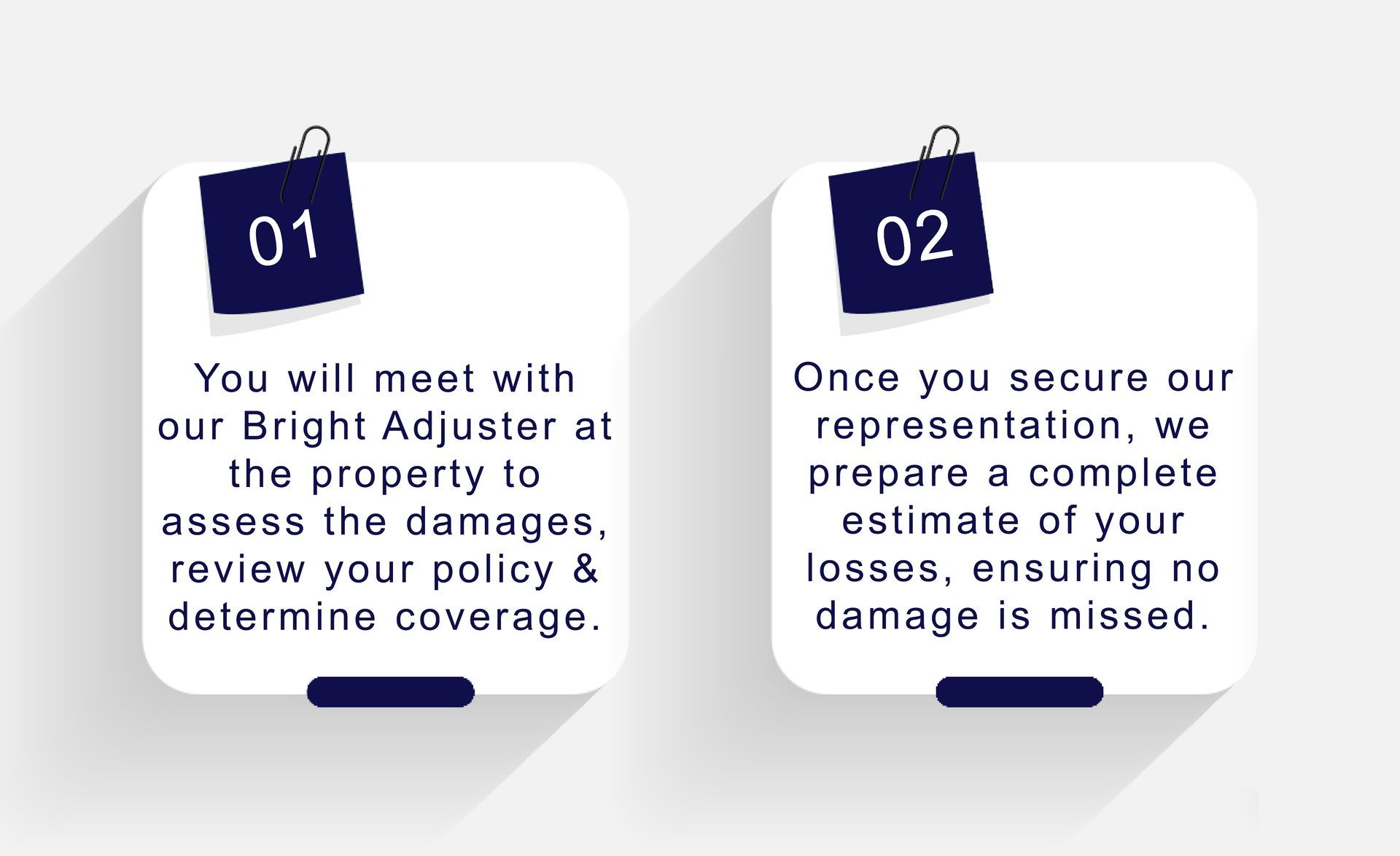

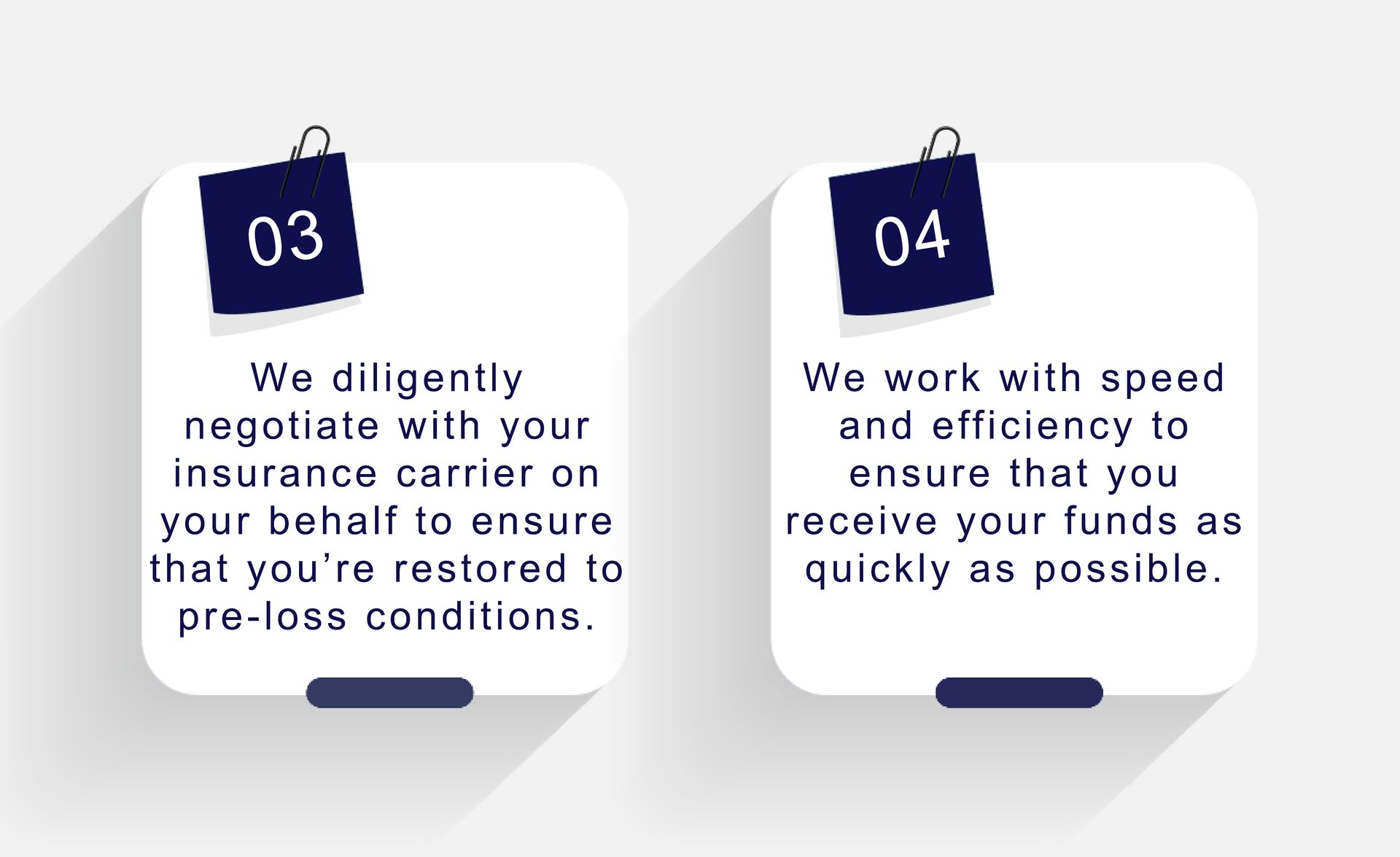

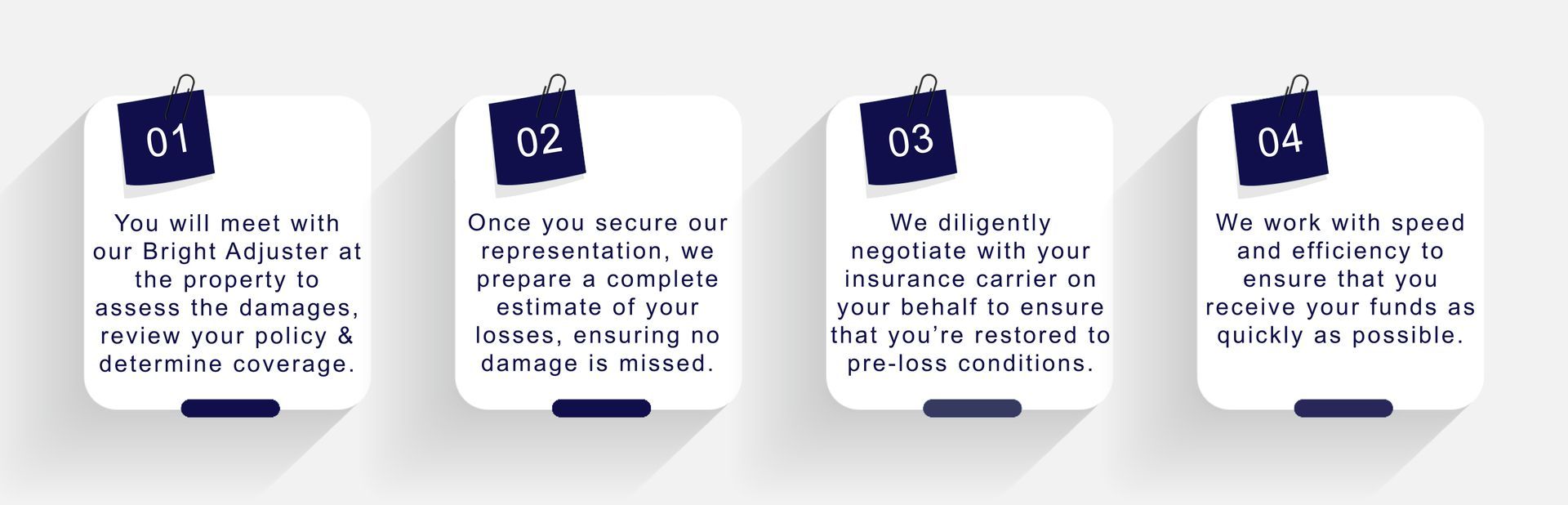

CLAIMS PROCESS

YOUR BRIGHT STORY IS NEXT

RONNIE C.

Home Owner / Sandy Springs, GA

"After discovering significant water damage in our basement and kitchen, I was overwhelmed by the prospect of dealing with our insurance company especially after being outright denied. I reached out to Bright Adjustments, and Moysh was incredible from the start. He meticulously assessed the damage, ensuring nothing was overlooked and handled all the complexities of our claim with true professionalism. Thanks to Moysh and his team at Bright Adjustments, we received a settlement that far exceeded our rough start, allowing us to restore our home. I can't recommend them highly enough for their diligence and expertise."

YOSEF C.

Home Owner / Buckhead, GA

“I was fortunate to connect with Moysh and Bright Adjustments while dealing with a challenging situation regarding roof damage to our home. We felt that our insurance company was dragging their feet without paying for the damages. As soon as we hired Bright Adjustments as our public adjusters, the entire process accelerated dramatically. Not only did we receive more communication from our insurance carrier, but we also finally understood what was happening in our claims process and where we were being shortchanged. My sincere thanks to the Bright Adjustments team for significantly changing the outcome and ensuring our home is being restored to great condition. We are now working with them on another claim for extensive water damage in a separate rental home, and we are confident in their ability to deliver.”

Do you take on denied claims?

Yes. We review every claim and discuss its merits with the insured to determine the best path to an optimal outcome.

Do you re-open closed claims?

Yes. Depending on the insured's policy, we advocate for the fullest extent of what you are entitled to.

Should I hire a public adjuster or an attorney to handle my insurance claim?

Both roles are crucial in the claims process. When we do our job correctly, the claim is often settled without the need for an attorney to be directly involved. Our experience working with insurance companies is grounded in the understanding that this is fundamentally a business of human beings and vital in getting claims paid. However, we collaborate with specific attorneys to resolve problematic claims. For instance, if an insurance company acts in bad faith and fails to provide reasonable compensation or the communication required by Georgia law.

Are there out of pocket fees that I as the insured will have to pay throughout the claims process?

For our services as your public adjuster, our fee is contingent upon claim recovery. If there's no recovery, there's no fee. Other services such as those provided by plumbers, engineers, or specialists are the responsibility of the insured.

How long does the claims process take to get paid from start to finish?

Since every claim is unique, durations vary. At Bright Adjustments our primary consideration is the interests of the insured. Therefore, our focus and strategy is based on the needs and direction of the insured.

Can I just file the claim myself to save money?

Insurance companies are a major business, after all. With their lengthy policies and specific language, our expertise lies in interpreting and presentating them to your carrier effectively.

Will my insurance carrier cancel my insurance if I submit a claim?

According to Georgia law, insurance companies must adhere to specific regulations when canceling insurance policies. Reasons an insurance company can cancel a policy are specifically if an insured fails to pay required premiums, misrepresents facts or commits fraud, or has more than two no-fault claims within a 36-month period.